A Radical New Crypto Just Blew Past The Bitcoin Price All-Time High—Up A Shocking 3,500% In Just One Month

Bitcoin and cryptocurrency markets have been dominated by decentralized finance, often shortened to DiFi, over recent months.

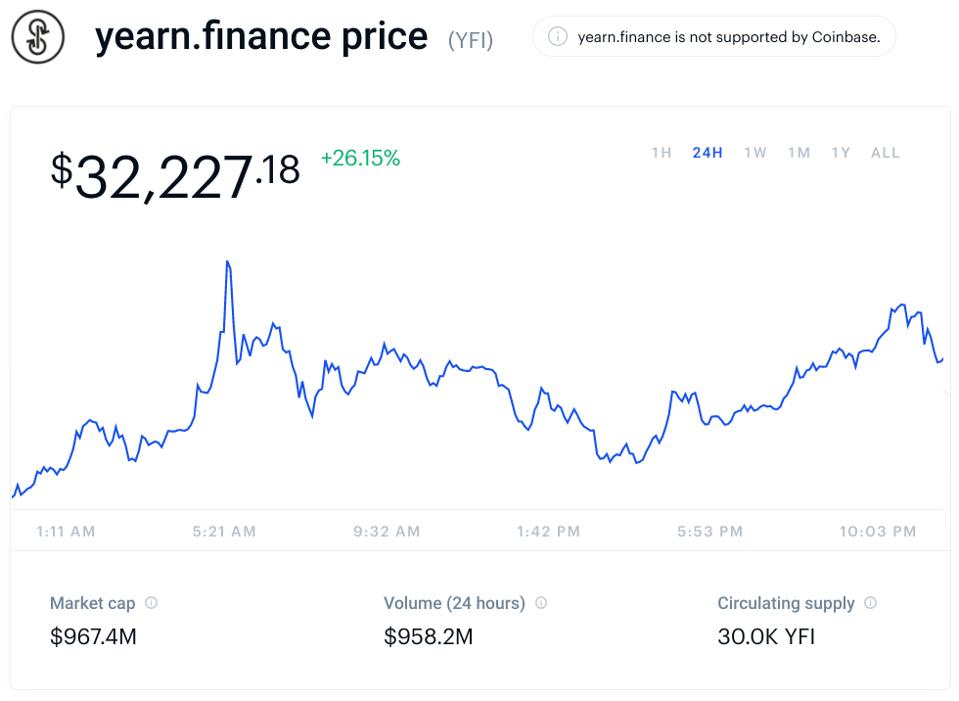

The bitcoin price, up around 40% since the beginning of 2020, has been left in the dust by the gains made some DeFi project tokens—including yearn.finance (YFI) that's up a staggering 3,500% in just a little over a month and has surged past bitcoin's late-2017 $20,000 all-time high.

The price of yearn.finance tokens have soared from under $1,000 per YFI since it was created in mid-July to over $30,000 this weekend, passing the bitcoin price on Friday. The yearn.finance price came close to $40,000 on some bitcoin and cryptocurrency exchanges before falling back.

YFI is the governance token of DeFi protocol yEarn, designed to aggregate yields from other lending protocols. DeFi is the idea cryptocurrency technology can be used to recreate traditional financial instruments such as loans and insurance.

YFI holders can use their tokens to vote on proposals for network upgrades and it can be earned by putting cash into yEarn, a practice known as yield farming.

"The yearn.finance coin has become the altcoin star recently," Alex Kuptsikevich, FxPro senior financial analyst, said via email.

"In a month it has shown twentyfold growth, living proof that 'unicorns' still exist, at least in crypto. The rapid growth of the coin also reflects the popularity of the decentralized financial sector. The creators of the project decided to follow the bitcoin path, limiting the issue of only 30,000 YFI coins. Such limited supply spurs rapid price growth."

This price growth was not something planned by the YFI creator, however. Yearn.finance tokens were described as "completely valueless 0 supply token," by its creator Andre Cronje.

"We reiterate, it has 0 financial value," Cronje wrote in a Medium post last month outlining the project.

"There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on uniswap, no, there won’t be an auction. We don’t have any of it."

But this warning hasn't stopped some of the biggest personalities in bitcoin and crypto from making outlandish predictions about the YFI price.

"One YFI [equals] $100,000," Arthur Hayes, the chief executive of the Seychelles-based bitcoin and cryptocurrency exchange BitMEX, said via Twitter, forecasting the yearn.finance price would continue to climb and hit $100,000.

Source: forbes.com

Comments

Post a Comment