A 23-year-old Aussie gamer dumped by his girlfriend because of his “addiction” to a cryptocurrency has had the last laugh now that his $17,000 investment has made him a millionaire.

Twitter and Reddit user “Grave” says he bought 100,000 Theta tokens in April 2020, paying 17c apiece.

But six or seven weeks later, his girlfriend found out and dumped him for “wasting my money on stupid fake internet currencies,” he recounted over the weekend.

“Almost a year later, today we peaked at $11.80 AUD im sitting on $1.180 mill and I wish I bought MORE!” he wrote on Saturday.

Grave is doing even better today, with the livestreaming token hitting a fresh all-time high of $US10.99 ($14.25) at 1.30pm AEDT.

At 2.09pm, Theta tokens were trading for $US10.76 ($13.95), up 11.5 per cent in 24 hours, giving the young father a nominal net worth of $1.4 million.

From their launch in February 2018 through last July, Theta tokens changed hands at less than US30c, and were available for US6.8c a year ago. That’s a 167-fold increase in the past 12 months.

Reached by Stockhead on Twitter, Grave declined to reveal his real name, saying he hadn’t told a lot of his family about his good fortune just yet.

“People who choose to follow me on theta.tv will will learn my identity in due time :)” he messaged.

He said he had cashed out 300k worth of tokens, “but I bought dips and bought more so im buying low and selling high,” and planned to buy more later.

“Im aiming for 150k tokens end of year” he wrote.

A screenshot Grave posted in May is strong corroboration for his story, showing he was bullish on the cryptocurrency long before it went parabolic.

As he alluded to, Grave has his own gaming channel on Theta.tv, the decentralised livestreaming video delivery network powered by the Theta token.

By attracting viewers, influencers earn rewards in the form of TFUEL tokens, the other token in the Theta ecosystem.

Theta’s rise and rise

In the past week and a half, Theta tokens have leapfrogged five other mostly older and better-known tokens — Litecoin, Bitcoin Cash, USD Coin, Stellar and Dogecoin — to become the 11th most valuable cryptocurrency by market capitalisation, according to Coinmarketcap.

Theta tokens are collectively worth $US11.2 billion, putting it just behind Chainlink, according to the website.

Grave wrote on Reddit he decided to invest in the token only after a lot of due diligence.

“I researched the shit out of it and just really liked what their desires for Theta network was. They were unique from day 1 and have really just shown incredible colours to that.”

He added that he hadn’t heard from woman who dumped him, and declined suggestions from other Redditors that he text her a screenshot of his balance.

Bitcoin, Ethereum down 4%

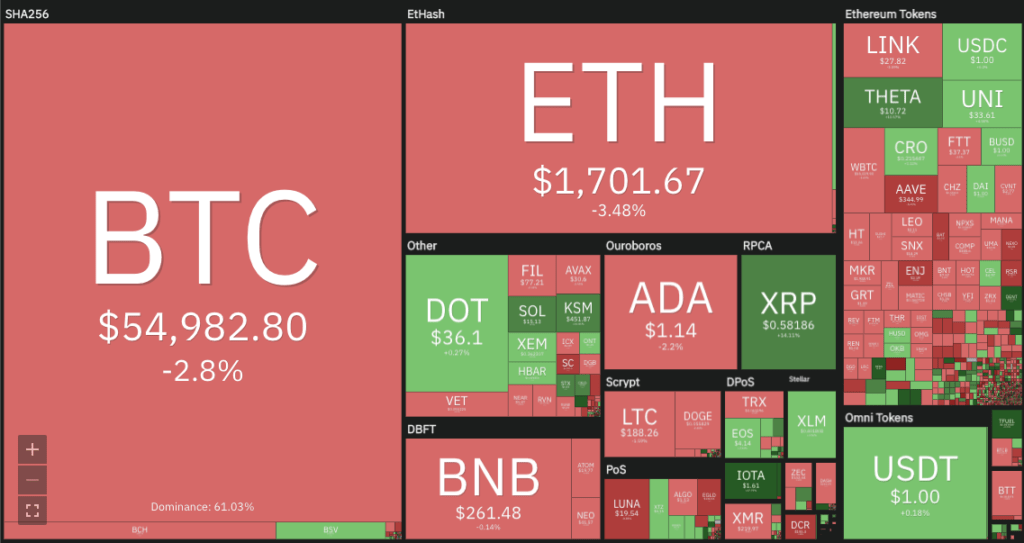

Theta’s performance today came even as the overall crypto market declined for the second day in a row.

Bitcoin was trading at $US54,850 ($71,000), down 4.4 per cent in the last 24 hours, according to Nomics.

Ethereum was changing hands at $US1,707 ($2,200), down 4.2 per cent.

Of the top 100 tokens listed on Coingecko, 82 were in the red and just 18 were in the green.

Dent was the top performer, up 54.6 per cent in the past 24 hours to US1.27c. The Ethereum token is designed to be used to swap mobile phone bandwidth.

It’s up nearly eightfold in the past 30 days, but still not near its all-time high of US10c it hit during the January 2018 bubble.

Uniswap, VeChain, Kusama, Leo Token, Bitmax Token, Arweave and Helium have been the other top 100 crypto tokens to hit all-time highs in the past 24 hours, according to Coingecko.

PS. In our blog pages we got hidden links where you can earn cryptocurrency for free.

Source: stockhead.com.au

Comments

Post a Comment