- Bitcoin proves that its correlation with the stock market is not a passing haze.

- S&P 500 futures opened in the red on Monday dropping over 3%; Bitcoin slumps under $9,000.

Bitcoin led the cryptocurrency market in red turbulent waters on Monday.

The king of cryptocurrency tanked under $9,000 for the first time in June. This move comes after a fairly stable weekend session.

Bitcoin ousted stability as volatility increased amid a stronger bearish grip. Prices on leading derivatives trading platforms plummeted to lows around $8,920.

Spot trading platforms also experienced a fall of the same magnitude. Currently, Bitcoin is down 2.2% on the day to trade at $9,118.

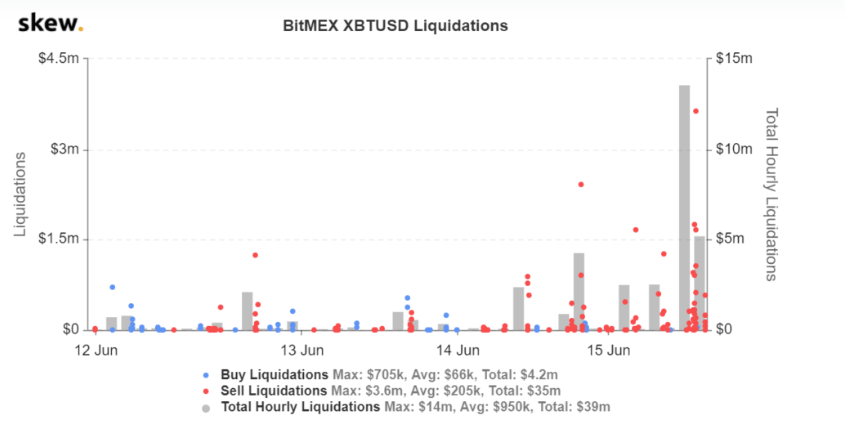

In just under 2 hours, about $20 million worth of long positions has been liquidated.

This according to data provided by the analysis platform, Skew.com.

In addition to that, in the last 24 hours, $10 million more in long positions had been liquidated.

As mentioned the losses are spread across the crypto landscape.

For instance, Ethereum is trading 3.54% lower with a market value of $223. Ripple has also not been spared and is doddering 2.98% lower on the day to trade at $0.1845.

The rest of the digital assets are nursing losses ranging from 1% to 6% on the day.

Bitcoin slides in tandem with the stock market

Bitcoin recently established a correlation with the stock market has also been witnessed with a fall stock market.

Most futures of American equities opened the week’s trading in losses.

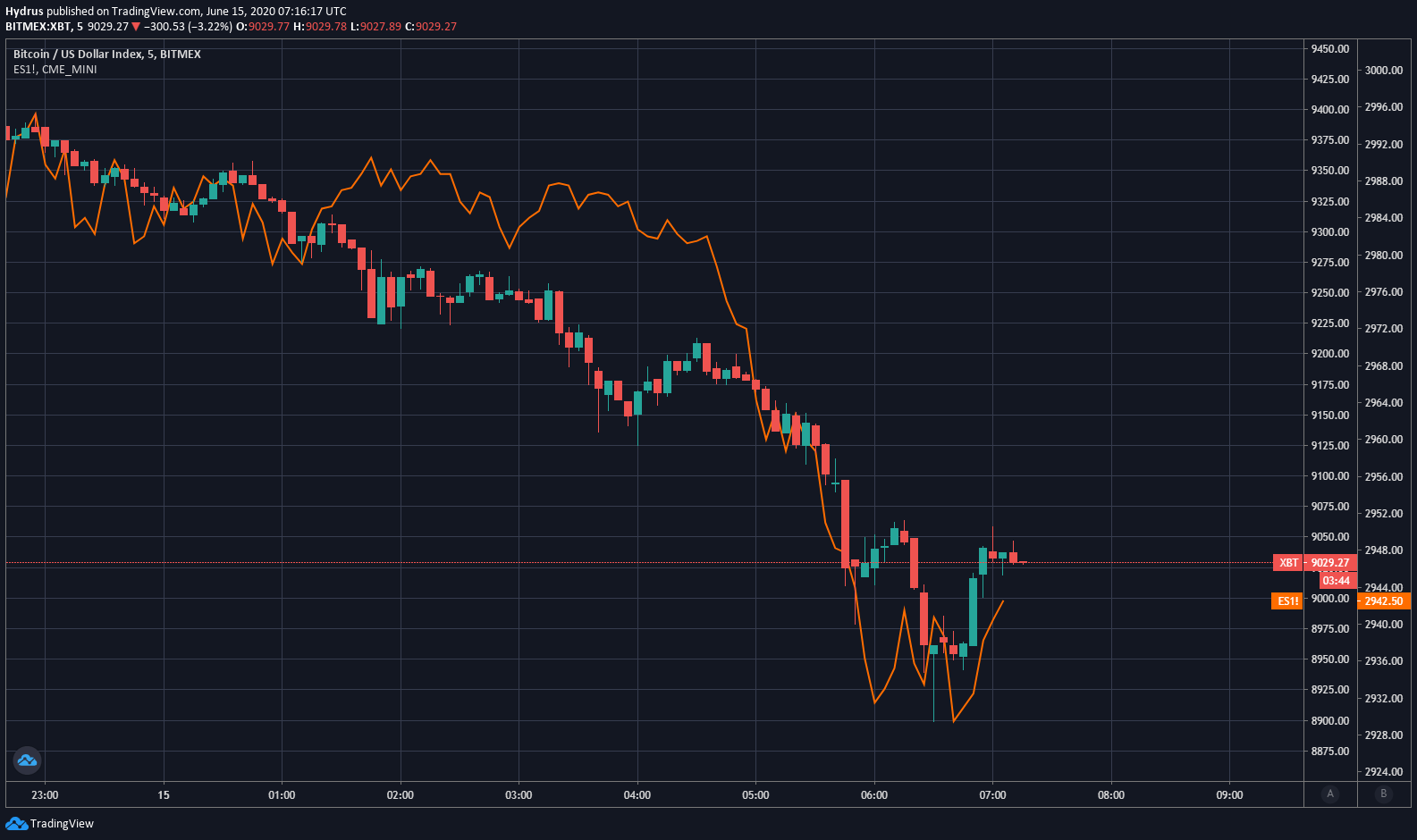

The below S&P 500 futures (ESI) chart shows that Bitcoin traded in tandem with the equities towards the end of the trading on Sunday.

Futures are down 3% on the day since opening which means Bitcoin has started to lead the recovery.

“Once equities correct strongly, odds that $BTC sees a correction too is large. Simple math, increased demand for cash may have its influence temporarily,” according to an analyst who predicted a V-shaped reversal from the devastating March crash.

Source: fxstreet.com

Comments

Post a Comment