Bitcoin price started seeing yet another apparent bull run only two days ago, on June 22nd. After the coin spent several days balancing above $9,250, it started surging up and breaking several minor resistances along the way.

BTC price sees sudden drops

Bitcoin’s positive performance brought a lot of optimistic predictions, one of which assessed that the bull run might take it back to the price of $12,000, or more. As many may remember, the last time BTC price was that high was almost exactly a year prior to the new surge.

However, the price hit a resistance at $9.650, which it tried to breach several times over the last 24 hours. Then suddenly, in the early hours of June 24th, it started collapsing once more.

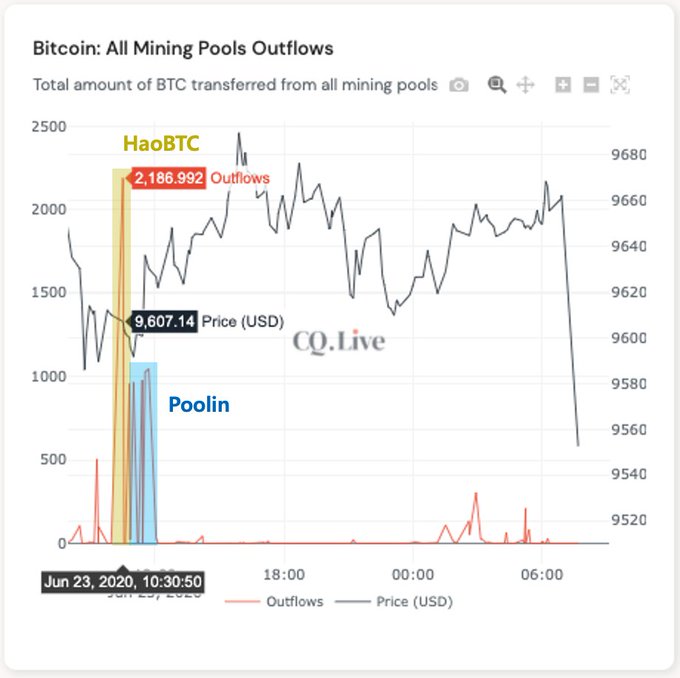

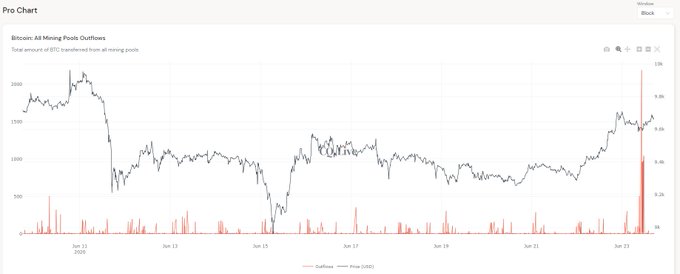

According to recent data, the new drop may have something to do with the recent behavior of two BTC mining pools. The data came from a blockchain monitoring service, CryptoQuant, which reported that two pools — HaoBTC and Poolin — started moving large quantities of BTC.

The mining pools released more than 7,153 BTC (roughly $68 million) in a single day, which likely caused the price to drop back to $9,500.

Are large pools starting to sell again?

From what is known, the move does not correspond with the change in exchanges’ balances. However, that doesn’t mean that the coins cannot be sold via OTC trading. In fact, it would make sense for the pools to sell them this way, considering that both are based in China.

While miners’ selloffs are known to be a major factor that influences BTC price performance, the outflows have been on a sharp decline ever since BTC experienced block halving on May 11th. Miners were reportedly sticking to their coins, at least when it comes to larger pools, while the smaller ones were quick to sell even back then.

At the time of writing, Bitcoin price sits at $9.537, which is about 0.55% lower than 24 hours ago. Still, this behaviour likely means the end of the bull run that was expected to take the coin to last year’s heights.

Source: invezz.com

Comments

Post a Comment