Bitcoin wobbles as the US dollar experiences a bout of optimism.

- Incoming Treasury Secretary Janet call for curbs on “reprehensible” Bitcoin

- Deutsche Bank says Bitcoin more likely to halve than double

- Crypto markets largely down as stock markets strengthen with US political stability

Bitcoin is trading around US$34,100 at the time of writing according to Coinbase.com. Bitcoin has led the crypto downturn today falling by as much as 8.2% to a low of $33,507 from the day’s high of $36,513.

Confidence in the political climate in the United States is resuming with the Biden administration being inaugurated today.

As a result, confidence in the strength of the US dollar has resumed with the dollar rising against Bitcoin purchasing 290 satoshis up from 230 satoshis at the height of the Bitcoin bull run in early January.

The market for altcoins is following Bitcoin’s wobbly price movements. Ether and Bitcoin Cash have both dropped by around 4.4% with Litecoin slightly worse losing 5.3%.

Negative sentiment following Bitcoin’s January all-time highs

Surveys released by Deutsche bank and Bank of America show very negative sentiment for Bitcoin with half of all managers surveyed responding that Bitcoin is very likely in a price bubble.

More than half of the respondents said Bitcoin shows more chance of halving rather than doubling.

In a Senate confirmation hearing to be sworn in as Secretary of the Treasury, Janet Yellen former Chief of the Federal Reserve Bank, said that Bitcoin needed to be curtailed and that regulations around Bitcoin required a co-ordinated effort to stamp out illegal activities such as “reprehensible” money laundering.

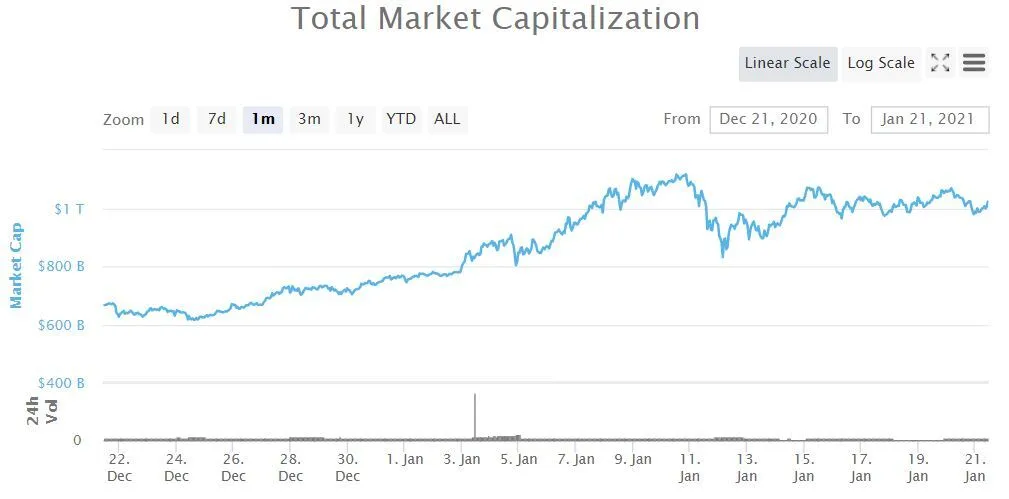

Total cryptocurrency market cap drops 19%

The image below shows the decline in total cryptocurrency market capitalization. The downturn since Bitcoin began experiencing resistance at $42,000 over a week ago has meant a 19% reduction in the overall value of the cryptocurrency market.

The drop could signal a shift away from the cryptocurrency market in favour of more traditional assets as the yields on long term treasuries are beginning to open up.

PS. In our blog pages we got hidden links where you can earn cryptocurrency for free.

Comments

Post a Comment