The Australian government, in its December 2018 Tech Future report, highlighted that Artificial Intelligence, Blockchain, Internet of Things (IoT) and Quantum Computing would bring opportunities for people, businesses and the broader economy.

Since then, significant progress has been made in this direction with more and more companies implementing these technologies.

As highlighted in Federal Budget 2020-21, COVID-19 pandemic steered the Australian companies and customers towards a digital transformation by making them embrace digital technologies to continue operating amid the crisis. The Government’s Digital Business Plan aims to build on this momentum to support better adoption of new technologies across the economy.

To reduce the regulatory barriers, one of the measures taken by the government include an investment of A$6.9 million over two years from 2020-21 to aid industry-led pilots to reveal the blockchain technology application to reduce regulatory compliance costs and support broader usage of blockchain by Australian businesses.

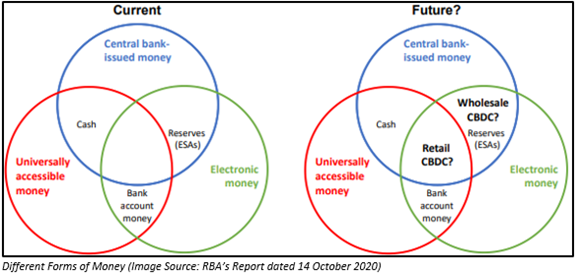

In present times, Australia uses both physical and electronic (digital) forms of currency. It should also be noted that most money in Australia already exists in digital format and is in the form of electronic ledgers at commercial banks and other authorised deposit-taking institutions.

Also, the Reserve bank of Australia (RBA) issues digital money in the form of balances in ESAs (Exchange Settlement Accounts) that banks and other entities can hold. The ESA balances can be used by banks to pay other ESA holders and resolve transactions between customers.

At present, individuals do not have direct access to central bank digital money. Individuals need to hold banknotes if they are looking for central bank money.

A Glance at Different forms of money that exist in Australia:

Recent Development in Blockchain Technology in Australia

Recently, the RBA took a step to explore the potential use and the effects of a wholesale form of CBDC using distributed ledger technology (DLT). The step forms a part of the ongoing research at RBA on wholesale CBDC. In this direction, the central bank, on 02 November 2020, announced that it is entering into a partnership with Commonwealth Bank, National Australia Bank, Perpetual and blockchain technology company ConsenSys Software.

Under this project, the objective would be the development of proof-of-concept for the issue of the tokenised form of CBDC. The form can be used for funding, settling, and repaying tokenised syndicated loan on an Ethereum-based DLT platform by wholesale market participants. The proof-of-concept will help discover the outcomes of ‘atomic’ delivery vs payment settlement on a DLT platform.

According to Michele Bullock, the Assistant Governor (Financial System), through this project, RBA is aiming to investigate inferences of a CBDC when it comes to effectiveness, risk management plus innovation in wholesale financial market trades.

A Glance at the National Blockchain Roadmap

Australia is home to several world-first blockchain applications. When blockchain technology is combined with other technologies can add economic value to several business sectors. In that direction, Australia can provide global annual business worth more than US$175 billion by 2025 through blockchain.

The blockchain roadmap set out a strategy for the Australian government industry, and researchers would help to capitalise on the prospects and address challenges.

The roadmap also reflects several businesses applying blockchain. These include:

- Agricultural supply chain in wine sector.

- Trusted credentials in the university sector.

- Transferable client checks in the finance sector.

Progress Towards National Blockchain Roadmap

As per a report released by the Australian Government, Department of Industry, Science, Energy and Resources on 09 October 2020, two new collaborative National Blockchain Roadmap Working Groups have been formed to assist the National Blockchain Roadmap Steering Committee.

The National Blockchain Roadmap Steering Committee includes representatives & specialists from the government, academic world, and the industry to explore the prospects of blockchain technology in Australia.

The members would assess blockchain technology’s use cases in Australia. They would concentrate on blockchain as an enabling technology that can support cybersecurity applications, and support companies lessen the regulatory compliance related burden.

The process would include a panel of government representatives and organisations like Standards Australia who would look into the group and give real-time advice and detect any cross-cutting issues.

The group would be developing and presenting an initial discovery report to the Steering Committee in early 2021.

Source: kalkinemedia.com

Comments

Post a Comment