- DBS Bank will launch a trading platform with Bitcoin (BTC), Ethereum (ETH) and XRP, according to a deleted post.

- DBS Digital Exchange platform will have the support of the Singapore Monetary Authority and will operate as a “traditional” exchange.

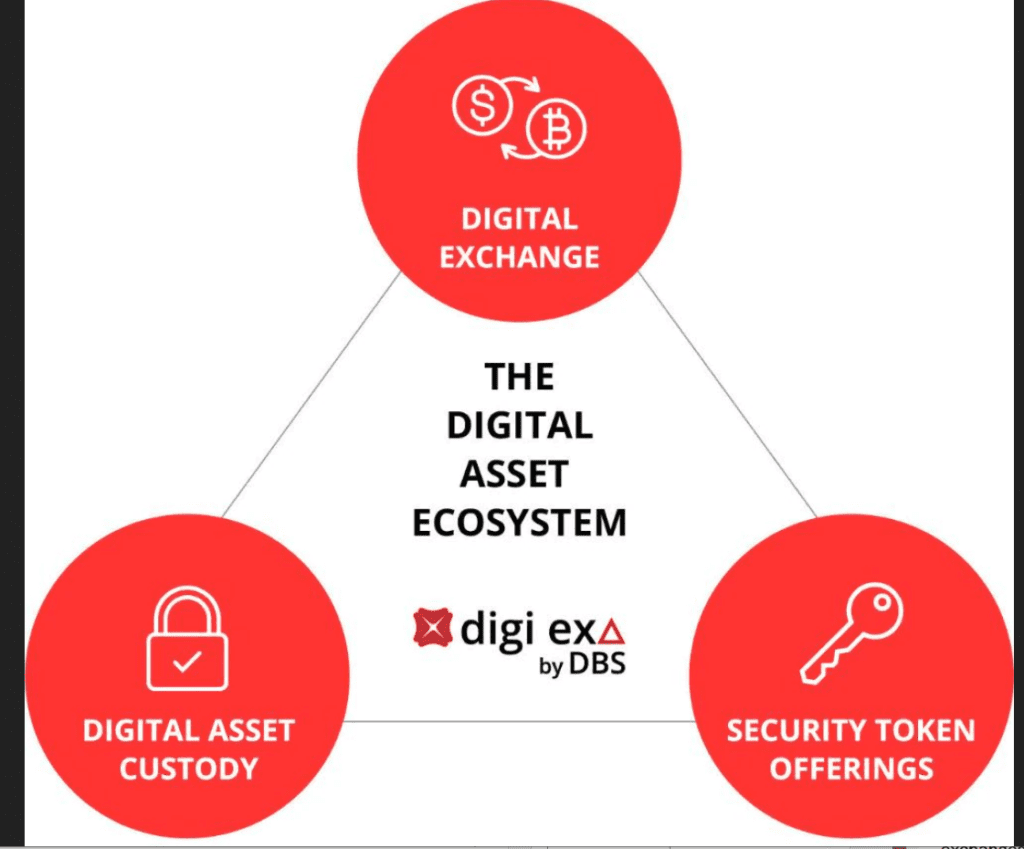

A report by The Block news media reveals the launch of a crypto exchange platform by the largest bank in South East Asia, DBS. Called DBS Digital Exchange (digi ex), the platform opens trading with Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH ), and XRP.

According to the report, the news was discovered after the publication of the exchange’s website. Currently the page has been deleted. However, it has been possible to verify that the Monetary Authority of Singapore supports the launch of the platform, according to the information on the deleted post.

Source: https://www.dbs.com.sg/documents/1038650/66112595/dbs-digital-exchange-asset-ecosytem%281%29.jpg/f3fa8d96-a169-99b7-7ac0-9e7d4de2cb6d?t=1602238804652&imagePreview=1

Users will be able to trade in the referred cryptocurrencies using the following fiat currencies: Singapore Dollar (SGD), Hong Kong Dollar (HKD), Japanese Yen (JPY) and US Dollar (USD). An additional feature, token security offering (STO), will be added in the future. These tokens will be supported by “real world assets”. For example, stocks, art, real estate, among others. According to the report, the page points:

Digital assets are poised to be the future of tomorrow’s digital economy. With DBS Digital Exchange, a digital exchange backed by banks, businesses and investors can now take advantage of an integrated ecosystem of solutions to tap the enormous potential of private markets and digital currencies.

Digi ex will operate like a traditional exchange

The platform will be directly available to institutional investors. This includes financial and banking institutions and market makers. However, a retail investor will need to access the platform with one of the DBS affiliates. For example, DBS Vickers Securities and DBS Private Bank.

Additionally, investors will be able to trade on the platform during more traditional hours. Trading will be closed on weekends. During weekdays, trading will only be possible from 9 am to 4 pm. About the custody of the cryptocurrencies, the bank says:

Unlike most digital exchanges today, DBS Digital Exchange does not hold any digital assets. Instead, all digital assets are kept at DBS Bank, which is globally recognised for its custodial services.

In the announcement, it is revealed that DBS has a custody solution called DBS Digital Custody with an “institutional” grade. Three Arrows Capital’s CEO, Su Zhu, and the founder of Digital Currency Group, Grayscale’s parent company, Barry Silbert said the news is extremely important for the crypto market. Zhu said:

DBS, the largest retail and commercial bank in Singapore, has soft launched their crypto/fiat trading exchange! This will immediately become the easiest on-ramp for those who bank in Singapore.

Our top recommendation: Buy Bitcoin, Ethereum, XRP and Cardano from Ethones

Comments

Post a Comment